Stonewell Bookkeeping Fundamentals Explained

Table of ContentsStonewell Bookkeeping - The FactsAn Unbiased View of Stonewell BookkeepingThe Basic Principles Of Stonewell Bookkeeping The smart Trick of Stonewell Bookkeeping That Nobody is Talking About10 Easy Facts About Stonewell Bookkeeping Shown

As opposed to experiencing a declaring cabinet of various papers, billings, and receipts, you can provide detailed records to your accountant. Subsequently, you and your accountant can save time. As an added incentive, you may even have the ability to identify potential tax obligation write-offs. After using your audit to file your taxes, the IRS might pick to perform an audit.

That funding can come in the form of proprietor's equity, gives, organization lendings, and investors. Investors require to have a good idea of your service before investing.

The Greatest Guide To Stonewell Bookkeeping

This is not intended as lawful recommendations; to find out more, please go here..

We answered, "well, in order to understand just how much you require to be paying, we need to understand just how much you're making. What is your internet income? "Well, I have $179,000 in my account, so I guess my internet revenue (profits less expenditures) is $18K".

Stonewell Bookkeeping - Questions

While it can be that they have $18K in the account (and also that might not be real), your equilibrium in the bank does not necessarily determine your earnings. If somebody got a give or a finance, those funds are not taken into consideration earnings. And they would certainly not infiltrate your revenue declaration in determining your profits.

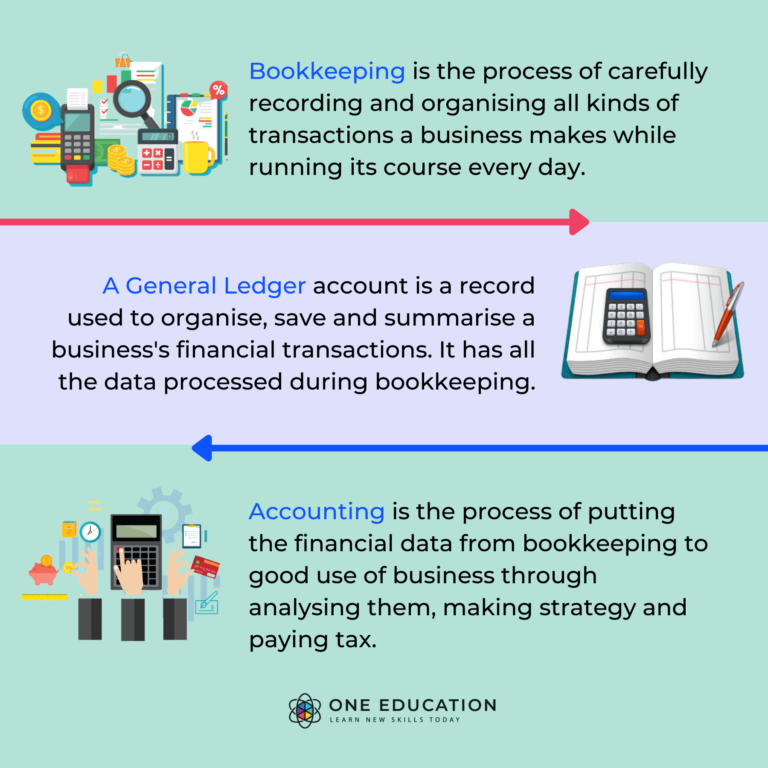

Numerous things that you assume are expenses and deductions remain in reality neither. A proper collection of books, and an outsourced bookkeeper that can effectively classify those deals, will certainly help you identify what your business is really making. Bookkeeping is the process of recording, classifying, and organizing a business's economic purchases and tax obligation filings.

An effective company needs help from professionals. With realistic objectives and a competent accountant, you can quickly attend to difficulties and keep those worries at bay. We dedicate our power to guaranteeing you have a solid monetary structure for development.

Getting The Stonewell Bookkeeping To Work

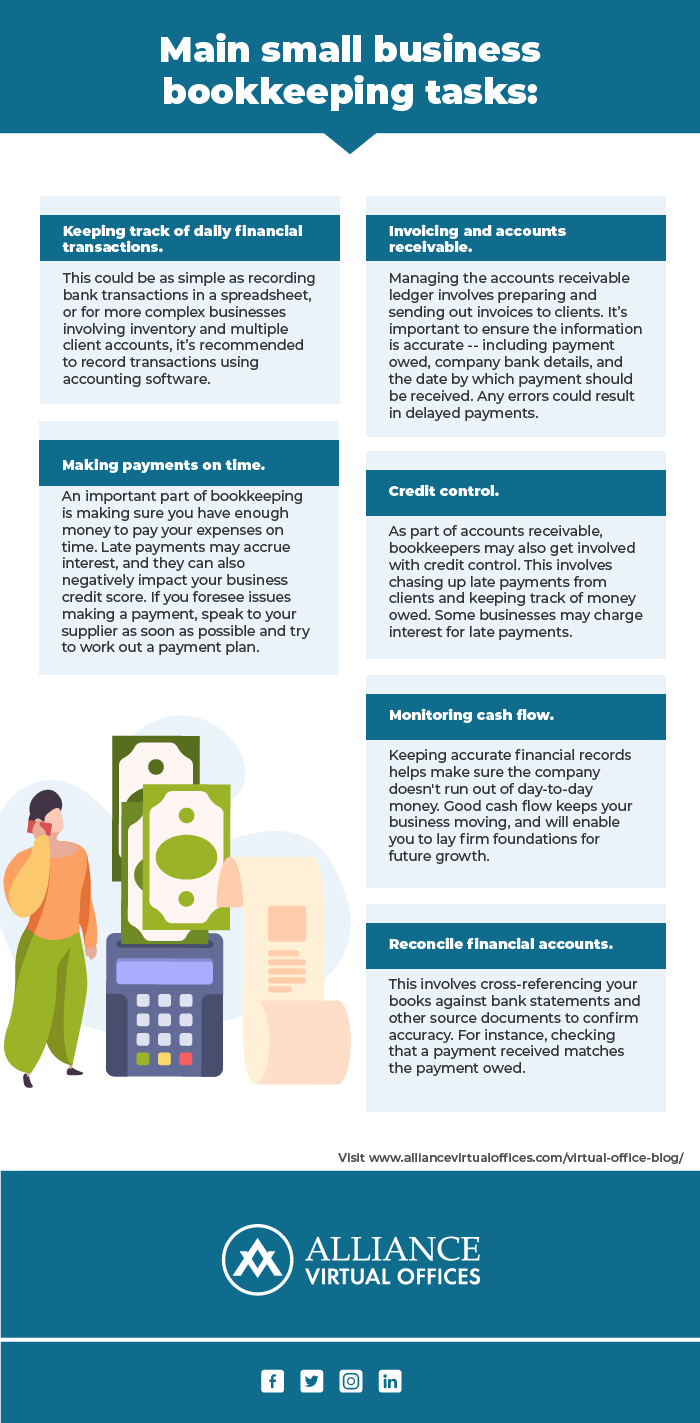

Exact bookkeeping is the backbone of good financial management in any kind of organization. It aids track earnings and costs, making sure every deal is taped effectively. With excellent accounting, services can make much better choices because clear monetary documents use important data that can lead approach and improve revenues. important link This details is essential for long-lasting planning and forecasting.

Accurate economic statements construct count on with lending institutions and capitalists, boosting your possibilities of getting the resources you need to grow., businesses must regularly integrate their accounts.

A bookkeeper will certainly cross financial institution statements with inner records at the very least as soon as a month to discover blunders or variances. Called financial institution reconciliation, this process guarantees that the monetary records of the business match those of the financial institution.

Cash Circulation Declarations Tracks cash movement in and out of the business. These records help business proprietors recognize their economic setting and make notified decisions.

Stonewell Bookkeeping Fundamentals Explained

The very best choice relies on your spending plan and service needs. Some small company owners prefer to handle accounting themselves making use of software program. While this is cost-effective, it can be taxing and prone to errors. Devices like copyright, Xero, and FreshBooks permit organization owners to automate bookkeeping tasks. These programs assist with invoicing, bank settlement, and financial reporting.